Maintenance of Adequate Books and Records for Registered Charities

Author: Celia Valel

Registered charities, including charitable organizations, private foundations and public foundations, have significant obligations with respect to maintaining their books and records.

The Income Tax Act (Canada) (the “Tax Act”) imposes certain of these requirements; furthermore, incorporated charities must be compliant with their governing legislation. It is important for registered charities to be diligent in maintaining detailed and accurate documentation to avoid having their charitable status revoked or their receipting privileges suspended.

Section 230 of the Tax Act requires that registered charities are required to keep records and books of account at an address in Canada recorded with the Canada Revenue Agency (the “CRA”) containing:

- information in such form as will enable the CRA to determine whether there are any grounds for the revocation of its registration;

- a duplicate of each receipt containing information for a donation received by it; and

- other information in such form as will enable the CRA to verify the donations to it for which a deduction or tax credit is available under the Income Tax Act.

A registered charity’s “books and records” include: governing documents, bylaws, financial statements, copies of official donation receipts, copies of annual information returns, written agreements, contracts, board and staff meeting minutes, annual reports, ledgers, bank statements, expense accounts, inventories, investment agreements, accountant’s working papers, payroll records, promotional materials and fundraising materials. Also included are corroborating “source documents” such as invoices, vouchers, formal contracts, work orders, delivery slips, purchase orders and bank deposit slips (Charities Directorate).

Books and records must be kept at the Canadian address that the charity has on file with the CRA. This includes all books and records related to any activity carried on outside of Canada. The charity’s books and records cannot be kept at a foreign address.

The Tax Act (section 231.1) empowers the CRA to inspect, audit or examine the books and records of a registered charity, and any document that relates or may relate to the information that is or should be in the books or records of the registered charity.

Books and records can be kept in electronic format. However, electronic books and records are subject to the general rules applicable to books and records, in addition to the following:

- Books and records that are created and maintained in electronic format must be kept in an electronically readable format, even if the charity has paper printouts of the electronic records.

- If any source documents are initially created, transmitted, or received electronically, they must be kept in an electronically readable format.

- Scanned images of paper documents, records, or books of account that are maintained in electronic format are acceptable if proper imaging practices are followed and documented.

Notably, books and records maintained outside Canada but accessible electronically in Canada do not meet the requirement of being kept in Canada.

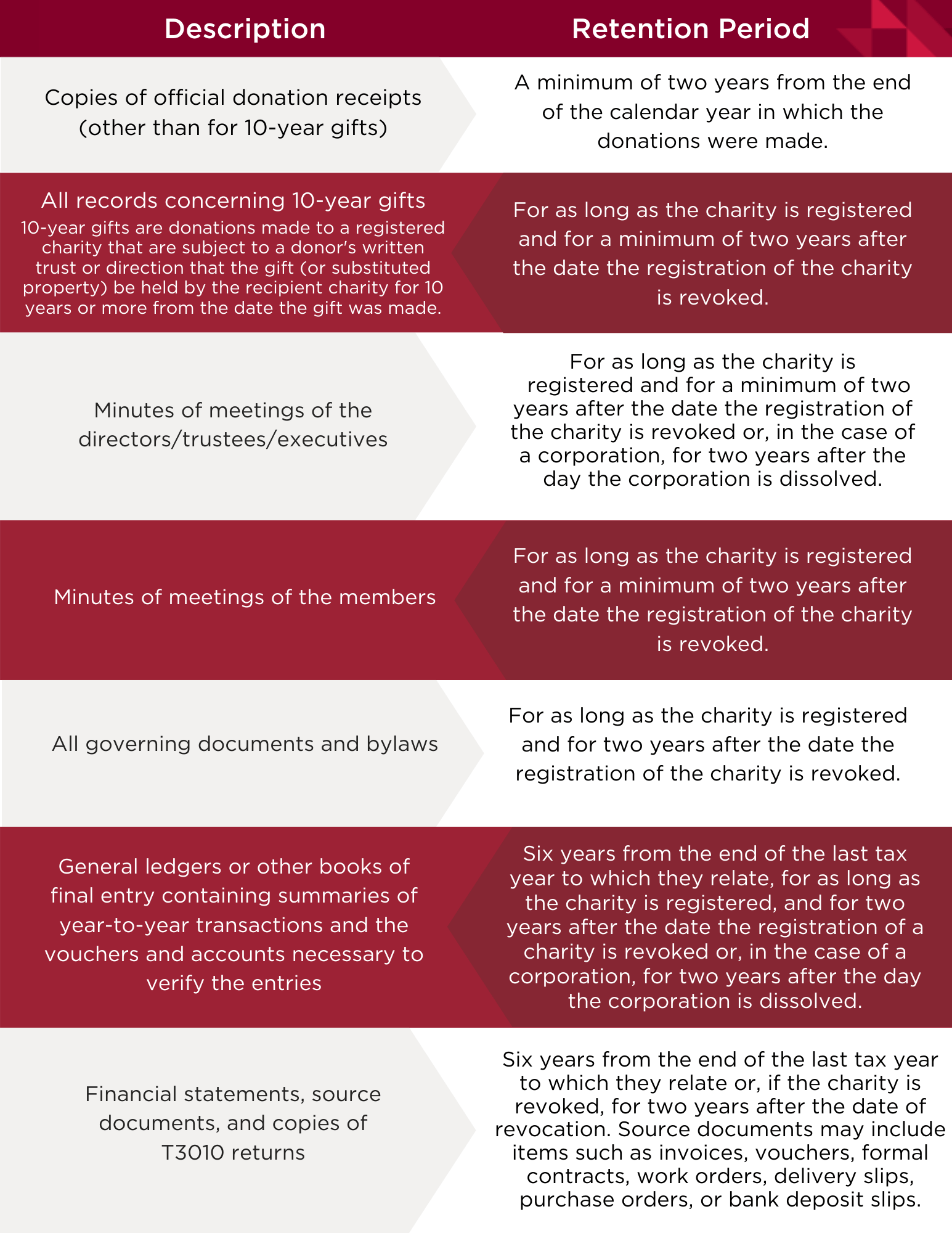

The Regulations to the Tax Act prescribe the period of time for which books and records must be maintained. This varies, depending on the type of books and records, and is summarized by the Tax Act as follows:

Failure to maintain adequate books and records can result in a suspension of the receipting privileges of the organization or the revocation of its registration (Income Tax Act, 168(1)(e) and 188.2(2)(a)).

In addition to the requirements set forth in the Tax Act, if the registered charity is an incorporated entity, the governing statute of the charity may impose additional requirements. For example, The Corporations Act (Manitoba), indicates that a corporation is required to prepare and maintain at its registered office (or at another place in Manitoba designated by the directors), records containing:

- the articles and the by-laws, and the amendments to them, and a copy of any unanimous member agreement;

- the minutes of meetings and resolutions of members;

- minutes of meetings and resolutions of the directors and of any committee of directors;

- a register of directors setting out the name, address and other occupation of each person who is or has been a director of the corporation, and the dates on which he or she became and, if applicable, ceased to be a director;

- a register of members; and

- adequate accounting records.

The Canada Not-for-Profit Corporations Act contains similar requirements, and in addition, requires that a register of debt obligations issued by the corporation and a register of the officers of the corporation be maintained.

In addition to the foregoing, charities should determine whether they have obligations under other legislation, including the Excise Tax Act, Canada Pension Plan and Employment Insurance Act.

It is essential that registered charities exercise diligence in maintaining their books and records. The lawyers of the MLT Aikins Charities and Not-for-Profits group are ready to assist you with any corporate legal needs your organization may have regarding books and records.

Note: This article is of a general nature only and is not exhaustive of all possible legal rights or remedies. In addition, laws may change over time and should be interpreted only in the context of particular circumstances such that these materials are not intended to be relied upon or taken as legal advice or opinion. Readers should consult a legal professional for specific advice in any particular situation.