Further significant increases to the CRA’s prescribed interest rates

The Canada Revenue Agency (“CRA“) increased its prescribed rates of interest for the third quarter by 60% over Q3 2022 levels after inflation reached heights not seen in decades.

Throughout 2022, inflation surged to levels last seen during the late 1970s and early 1980s, peaking at 8.1% in June before tapering off to 6.7% in December. To combat rising prices, the Bank of Canada has consistently raised interest rates, with the overnight lending rate rising to 4.5% in January. When the Bank of Canada increases the interest rate, the CRA’s prescribed interest rates generally also increase.

The CRA charges a prescribed rate of interest on tax debts owing, including overdue federal income tax remittances, Canada Pension Plan contributions, Employment Insurance premiums, Goods and Services Tax (“GST“) or Harmonized Sales Tax (“HST“) remittances and excise tax remittances. The CRA also charges a prescribed rate of interest for interest-free or low-interest loans paid to employees or shareholders where such loans qualify as a taxable benefit.

When taxpayers make an overpayment to the CRA, the CRA pays them a low prescribed rate of interest. This rate is different for corporate and non-corporate taxpayers.

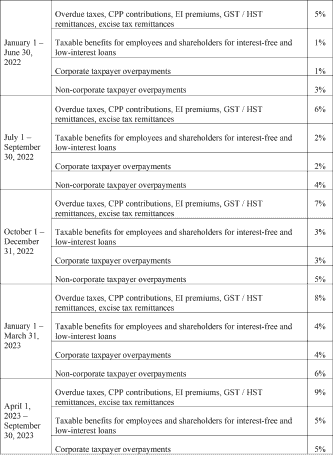

For the first half of 2022, the CRA charged a prescribed rate of interest of 5% on overdue payments, 1% on taxable benefits, 1% on corporate taxpayer overpayments and 3% on non-corporate taxpayer overpayments. These rates increased during the third and fourth quarters and have now increased again for the first three quarters of 2023. Currently, the CRA is charging a prescribed rate of interest of 9% on overdue payments, 5% on taxable benefits, 5% on corporate taxpayer overpayments and 7% on non-corporate taxpayer overpayments. See below for a summary of the changes:

Calculating the prescribed rate

The CRA’s prescribed rate is determined every three months. The starting point is the average yield of three-month government treasury bills sold during the first month of the previous quarter. Underpayment rates (i.e. when a taxpayer owes the CRA) are first rounded to the next highest whole percentage point, and then four percentage points are added to reach the prescribed rate. Overpayment rates (i.e. when the CRA owes a taxpayer) are simply rounded to the next highest whole percentage point.

Importantly, the prescribed interest rate is compounded daily; meaning that interest accruing each day is added to the principal balance, to which interest is applied the next day, and so on. This can increase outstanding balances rapidly, especially where outstanding amounts are large and/or have been owing for longer periods of time.

Taxpayer relief and voluntary disclosures

The increased interest rates may give rise to some serious interest costs on unpaid or unreported amounts in the future. Those unpaid amounts may give rise to questions as to whether taxpayer relief or voluntary disclosure application is in order. In a rising interest rate environment, it is useful to remember that taxpayers have these two options available to them.

Taxpayers can seek discretionary relief under the Income Tax Act (“ITA“) from penalties and interest charged on outstanding balances. Relief can relate to any tax year that ended in the 10-year period before the calendar year that a taxpayer’s request is filed. In general, the CRA will consider allowing some relief from interest and/or penalties if the amounts were caused by extraordinary circumstances or events outside a taxpayer’s control. However, there are many circumstances in which a request for relief may be granted.

Taxpayers may also consider using the CRA’s Voluntary Disclosures Program to avoid penalties if they discover that they filed inaccurate or incomplete information or failed to report necessary information to the CRA. Relief may be considered where a taxpayer failed to report any taxable income received, claimed ineligible expenses, failed to remit source deductions, failed to report GST or HST, failed to file information returns or failed to report foreign source income that is taxable in Canada, among other scenarios. Taxpayers who make a valid disclosure will be required to pay the taxes or charges, but without any penalty or prosecution they would otherwise be subject to under the ITA. The CRA may also grant partial relief in applying interest against a taxpayer if a disclosure is valid.

If you have any questions about whether you or your business would qualify for relief from interest rates, please contact one of our tax advisers.

Note: This article is of a general nature only and is not exhaustive of all possible legal rights or remedies. In addition, laws may change over time and should be interpreted only in the context of particular circumstances such that these materials are not intended to be relied upon or taken as legal advice or opinion. Readers should consult a legal professional for specific advice in any particular situation.