Takeaways from three years of Ontario construction adjudication statistics

There are now three years of statistics available on Ontario’s construction adjudication system. These statistics indicate potential implications for the future of construction adjudication through Ontario and Western Canada, where adjudication came into force in two provinces in 2022 (Saskatchewan, Alberta) and is being considered in other provinces (Manitoba, British Columbia).

Construction adjudication has been available in Ontario since October 1, 2019. Ontario’s adjudication system is administered by the Ontario Dispute Adjudication for Construction Contracts, who put out an annual report (see our review of the 2021 Annual Report here).

These statistics show key takeaways that suggest how adjudication will continue to develop both in Ontario and in other provinces adopting construction adjudication systems. Key takeaways include:

- Significant growth over time in the number and amounts claimed, particularly in the residential construction sector

- Gradual growth of adjudication to involve multi-million dollar disputes

- Adjudications have generally seen low success rates in awards from determinations

Significant growth in number of adjudications and amount claimed

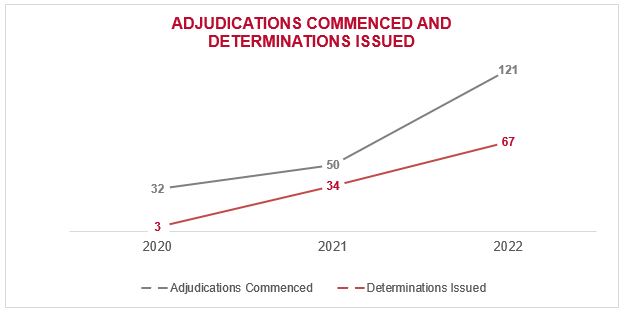

As adjudication has become available on more projects, the number of project participants using the adjudication system has significantly increased. There have been significant year over year increases in both the number of adjudications commenced and the amount of determinations issued.

The disparity between adjudications commenced and determinations issued indicates that, at an aggregate level, many adjudications are not being pursued to final determination, and are either being abandoned or settled prior to an adjudicator issuing a determination. As ODACC’s reports do not include statistics on settlements outcomes or values, it is unknown if the adjudications not being pursued to final determination are being resolved in the claimant’s favour outside of the adjudication process or just being abandoned.

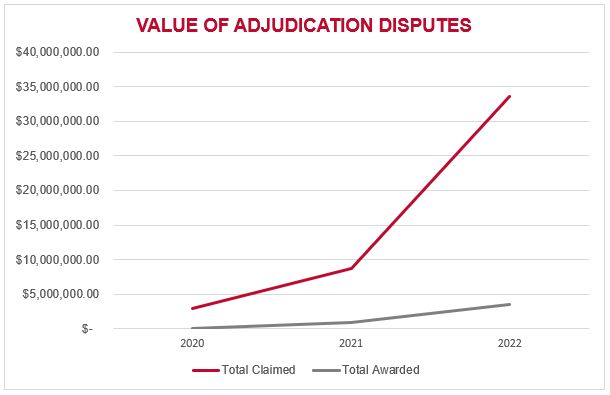

The amount claimed in adjudication has also risen significantly, with the 2022 report showing over $35,000,000 in adjudication claims initiated, and nearly $3.5 million in adjudication awards.

The large amounts claimed indicate that all construction industry participants in jurisdictions with adjudication need to understand how adjudication works and be prepared to respond in the tight timelines given the potential amounts at stake.

Increasing prevalence of large disputes

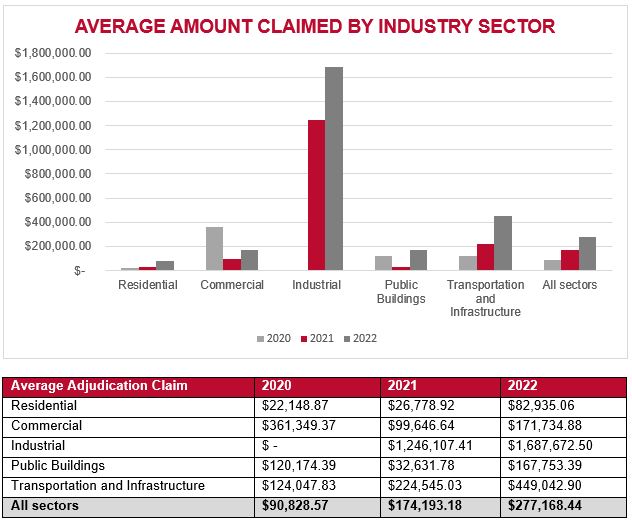

The amount claimed in adjudication has steadily increased over time, with the overall average adjudication claim going from $90,828.57 in 2020 to $277,168.44 in 2022 (a 305% increase).

In particular, for both 2021 and 2022, industrial sector disputes were over $1,000,000 per average claim. Transportation and infrastructure adjudication disputes also saw significant grown in dispute value to $449,0942.90 in average (over $13 million claimed against only 30 disputes). However, this may be driven by a few large claims as the median claim value was far lower at $277,178.43.

The chart and table below show the average amount claimed by sector, by year:

The implication of this is that over time, particular in certain sectors such as industrial or transportation, adjudication is likely to be the venue for significant dollar value disputes to be heard. Given that adjudication has no monetary limit in any current provincial legislation, there is a likelihood of continued adjudication of large disputes.

Claimants have generally been unsuccessful

Despite significant adjudication claim ($35+ million in 2022), the aggregate success rate of adjudication claims is low overall. For both 2021 and 2022, the average amount awarded by adjudicators was only around 10% of the average amount claimed (10.4% and 10.3%, respectively).

This is potentially surprising, as claimants generally have an advantage in being able to prepare their claim prior to initiating the fast-track adjudication process. Some potential explanations for the claimants’ overall lack of success include:

- Incomplete adjudications. As discussed above, since over 50% of adjudications commenced did not had a determination issued, a significant portion of claims are being abandoned/settled outside the adjudication process, resulting in aggregate adjudication awards being lower. This means that claimants may be “succeeding” just by initiating their claim (and having it paid), rather than having to complete the entire adjudication process. For example, in 2022, 24 of 121 adjudications were terminated prior to a determination, with 17 of those being settled outside the adjudication process.

- Partially successful claims. Some successful claims may only be succeeding for part of the claimed value, leading to a lowering of the average successful rate.

- Difficulty for large claims. The fast-track adjudication process, with generally limited page numbers for submissions and evidence, may not lend itself to significant awards for complex claims.

Of course, these speculative explanations are only three of many potential explanations, with some of the variance explained by statistical oddities skewing the results. Since adjudication is a private dispute process, the available statistics only tell the story at the aggregate level.

However, one sector that bucks the trend is residential construction adjudications. Residential claims are nearly twice as successful on average, with both 2021 and 2022 statistics showing residential claims being successful for 20% of claimed value, nearly twice the rate of the average claim success across all sectors. However, as shown in the tables above, average adjudication claims in the residential sector are far lower than other sectors.

This may indicate that despite the overall increased in the value claimed across all sectors, adjudication is proving to be an effective and cost-efficient way of obtaining an award in the much lower value residential sector compared to other sectors.

Owners, developers, contractors and subcontractors in the residential construction industry need to increase their vigilance on adjudication claims as they are, in general, more likely to be pursued successfully.

Overall, the three years of experience in the Ontario potentially foreshadows what may hold for the adjudication systems in Alberta and Saskatchewan as they take hold – the overall growth of the sector over three years indicates the importance of being prepared and vigilant for adjudication. Other jurisdictions considering adjudication legislation, such as Manitoba and British Columbia, may be mindful of the Ontario adjudication experience in designing their own adjudication systems.

The construction lawyers at MLT Aikins are well equipped to help all industry professionals. Contact a member of our Construction team to learn more.

Note: This article is of a general nature only and is not exhaustive of all possible legal rights or remedies. In addition, laws may change over time and should be interpreted only in the context of particular circumstances such that these materials are not intended to be relied upon or taken as legal advice or opinion. Readers should consult a legal professional for specific advice in any particular situation.